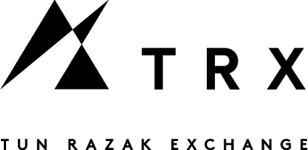

Financial technology (FinTech), the use of technology to deliver financial solutions, has been a key supply-side driver for what has been dubbed the “Fourth Industrial Revolution” by the World Economic Forum.

As of the first half of 2018, global FinTech investments have reached US$57.9 billion.

Global Fintech Overview

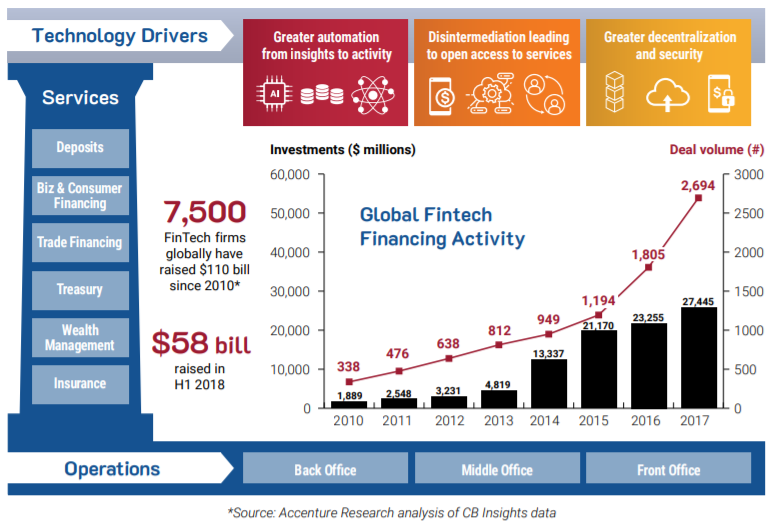

A burgeoning subsector has emerged in the form of Islamic FinTech, delivering Shariah-compliant financial products, services and investments.

With Islamic Finance total assets predicted to reach US$3.9 trillion by 2022, and around 1,400 Islamic financial institutions now operating across 80 countries, the prospects for Islamic Fintech are tantalising.

Islamic Fintech Overview

There are approximately 1.8 billion potential customers of Islamic FinTech in the world today, with a young, digitally native Muslim demographic, on average younger than the world’s non-Muslim population.

By 2100, the population of MENA, Sub-Saharan Africa and Southeast Asia is projected to constitute more than half the world’s population.

These markets are often deeply underserviced and diverse, but enjoy high mobile phone penetration. This creates opportunities for microcredit, money transfers and bill payments, alongside security and identification that comes with phone-based biometric applications, such as fingerprints, facial recognition and eye scans.

Add to this that only about 3 percent of global venture capital went into Islamic geographies, while Islamic trade finance, worth US$186 billion, is still only a fraction of the global US$12 trillion trade finance industry, and what emerges is a highly promising growth prospect.

“The global requirement for digital infrastructure investment is an opportunity for Islamic banks, asset managers and investors to harness, through Islamic FinTech, both in Islamic and non-Islamic economies,” Lawrence Wintermeyer and Abdul Haseeb Basit writes in Forbes’ online magazine.

“Islamic Fintech offers the opportunity to transform the lives of millions of people globally.”

The industry has the potential to make transactions quicker and easier, improve traceability and security, expand Islamic finance penetration and enhance governance.

Islamic FinTech can also level the playing field between Islamic financial institutions and conventional rivals who are often much larger and thus better able to handle the industry’s high entry and fixed costs.

FinTech can be harnessed to significantly lower Islamic banks’ administrative and security expenses.

Support from public and private sectors

Governments in Muslim-majority countries have been quick to action. The Dubai Islamic Economy Development Centre (DIFC) offers a US$100 million FinTech Fund, and has developed the FinTech Hive accelerator. Bahrain launched a FinTech Unit in the Central Bank and FinTech Bay, designed to be the largest FinTech hub in MENA.

Dubai, Abu Dhabi and Bahrain have all developed regulatory sandboxes.

Private sector leaders include the Islamic Fintech Alliance in Singapore, Turkey-based Al-Barakah Banks Accelerator, and ALGO Bahrain opened the world’s first FinTech consortium of Islamic banks.

Malaysia - already producing more than 26 percent of the world’s Shariah-compliant financial assets, worth US$528.7 billion - hosted the inaugural Global Islamic Fintech Summit in 2018.

The country is home to the largest number of Islamic FinTech start-ups, including savings platform HelloGold who won “Best Islamic Wealth Management Fintech Company” at the World Islamic Fintech Awards (WIFA), and Ethis Crowd, which has successfully crowdfunded for 5,000 houses as of 2017.

AI, blockchain key to future innovations

A 2018 report by the DIFC and consultants DinarStandard outlined key areas where growth can be expected, namely leveraging big data, AI and blockchain.

“Successful deployment of a blockchain-based FinTech solutions by Islamic banks would greatly expand the number of SMEs that could be financed,” Chief Executive of Qatar Financial Centre Yousuf Mohamed Al-Jaida told Reuters.

Rushdi Siddiqui, Mentor, Islamic Economy, Quest Ventures (Singapore) agrees.

“Banking is about data and its management. Artificial Intelligence and blockchain will re-engineer Islamic finance,” he said to Reuters.

A good example is the world’s first digital sukuk launched by New York-based Blossom Finance, which won "Most Innovative Use of Blockchain for Islamic Finance" at the WIFA Awards.

The SmartSukuk™ platform uses the Ethereum blockchain to bring in retail investors, with proceeds deployed to fund sharia-compliant microfinance initiatives in Indonesia.

Using a profit- and risk-sharing model, Blossom aims to provide an annual return of about 9% to investors.

Sukuk using blockchain dramatically increases the accessibility of sukuk financing using digital technology by reducing the complexity and cost previously required to issue and invest in sukuk.

"Public sukuk markets have been inaccessible to smaller issuers and investors due to the huge fees of various middleman. Using blockchain, we've removed the inefficiency from the process" noted Blossom Finance Chief Strategy and Risk Officer Khalid Howladar.